Personalized Business Administration Provider

From critical planning and monetary management to human sources and innovation assimilation, personalized administration services cover a large range of crucial locations that are crucial for a business's success. In this conversation, we will certainly check out the advantages of customized administration solutions, delve into the vital areas they cover, and emphasize success stories of firms that have leveraged these solutions to achieve impressive results. Let's dive in and find just how customized business monitoring solutions can change your organization.

Benefits of Personalized Monitoring Provider

The benefits of using tailored monitoring solutions are various and can greatly improve the performance and effectiveness of a business's operations. One of the crucial benefits is boosted decision-making. Custom-made monitoring services provide access to real-time data and analytics that allow supervisors to make educated choices based on up-to-date and accurate information. This can result in faster and more effective decision-making, which is vital in today's hectic organization setting.

One more benefit is raised efficiency. Customized management services simplify procedures and automate repetitive tasks, maximizing staff members' time to concentrate on even more value-added and tactical tasks. This not only boosts productivity but additionally enhances staff member satisfaction and spirits.

Additionally, tailored monitoring services can result in cost financial savings. By maximizing processes and removing ineffectiveness, business can lower operational prices and improve their lower line. Additionally, these solutions typically offer scalability, allowing business to conveniently grow and adjust as their demands change.

Additionally, tailored monitoring solutions can enhance danger monitoring. With accessibility to detailed data and analytics, companies can recognize possible risks and take aggressive procedures to minimize them. This can aid avoid expensive errors and make sure business continuity.

Key Areas Covered by Monitoring Provider

An extensive range of areas is covered by administration services to make certain effective and efficient procedures within a firm. One of the key areas covered by administration solutions is economic management.

An additional essential area covered by management solutions is personnel monitoring. This includes tasks such as recruitment and training, growth and selection, efficiency administration, and staff member relations. Efficient personnel monitoring is crucial for building a inspired and competent labor force, ensuring that the ideal ability is in location to drive the company's success.

Functional administration is another essential location addressed by administration solutions. This includes maximizing procedures, enhancing productivity, and carrying out quality control steps. By analyzing and reengineering workflows, administration solutions assist business attain functional performance and deliver top notch products and solutions to their consumers.

Additionally, monitoring solutions often cover strategic preparation and implementation. This involves setting objectives, creating approaches, and monitoring development towards attaining business goals. By offering calculated support, monitoring solutions aid firms remain affordable and adapt to changing market conditions.

How Customized Management Services Improve Efficiency

Customized monitoring services play an important function in improving efficiency within companies by tailoring their proficiency to satisfy certain business needs. By understanding the special obstacles and goals of a business, these services can make and carry out methods that streamline operations, enhance processes, and take full advantage of productivity.

One manner in which customized monitoring services boost performance is with the execution of targeted options. These services perform a detailed analysis of the firm's present practices and determine locations where enhancements can be made. They after that establish customized approaches and action strategies to resolve these particular locations, making sure that resources are assigned effectively and jobs are carried out effectively.

Additionally, customized monitoring services often leverage modern technology to automate and enhance processes. They recognize possibilities for digital transformation and apply tools and systems that get rid of hand-operated jobs, reduce mistakes, and enhance cooperation. By accepting technology, firms can optimize their process, minimize costs, and enhance overall performance.

Picking the Right Monitoring Services Provider

When choosing an administration services carrier, it is vital to thoroughly review their knowledge, industry understanding, and performance history of success. Choosing the right monitoring providers can substantially impact the success and efficiency of your firm. To guarantee that you make the ideal decision, consider the following elements.

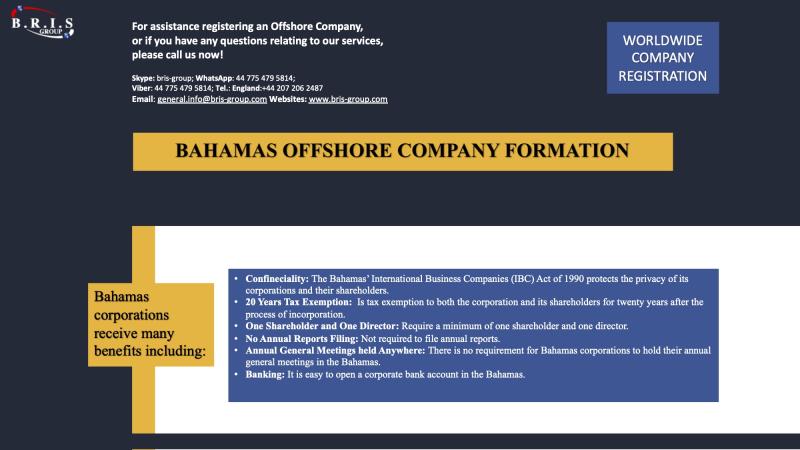

Following, examine the company's track document of success (formation of offshore companies). A company with a tried and tested track record is extra likely to supply the wanted outcomes and assist your company attain its goals.

Finally, take into consideration the variety of solutions and solutions that other the company supplies. Determine if they can meet every one of your management needs or if you will need to engage numerous providers. It is often much more reliable and cost-effective to function with a solitary carrier that can supply a comprehensive collection of solutions.

Success Stories of Companies Making Use Of Customized Management Services

Business that have selected the ideal administration companies have experienced remarkable success and achieved their goals through customized services. These success stories serve as a testament to the performance of customized management solutions in driving development and making the most of productivity.

By partnering with a monitoring services service provider that supplied customized services, Firm X was able to determine and resolve ineffectiveness in its production process. As a result, the firm's income grew by 20% within the initial year of adopting the tailored management services.

An additional significant success story is Business Y, an innovation start-up that did not have the needed knowledge to properly manage its financial resources and scale its find out here now operations. By partnering with an administration services company that specialized in monetary administration for startups, Company Y was able to get accessibility to skilled monetary guidance, streamlined bookkeeping procedures, and tailored economic coverage devices.

These success stories highlight the transformative impact that tailored monitoring services can have on companies of all sectors and sizes. By leveraging the proficiency and tailored services provided by a relied on administration solutions provider, firms can get rid of difficulties, drive development, and accomplish their calculated goals with self-confidence.

Verdict

In final thought, tailored management services provide countless benefits for firms, including boosted efficiency and efficiency. Several companies have already seasoned success by utilizing customized administration solutions to streamline their procedures and drive development.

From strategic planning and monetary management to human resources and innovation assimilation, tailored management services cover a broad variety of crucial locations that are crucial for a firm's success.Additionally, personalized administration services can improve danger management. One of the key areas covered by management solutions is financial management.Another crucial area covered by administration solutions is human resource monitoring. By partnering with a management solutions carrier that specialized in financial management for startups, Company Y was able to obtain access to professional monetary guidance, streamlined accounting processes, and tailored economic coverage tools.